A product strategy describes what problem your product should resolve; it considers markets, needs, value proposition, features, and user experience.

As we emphasized on our B2B marketing strategy guide, a strategy is not a tactic.

The strategy will allow us to answer the broadest business questions, like, how we will achieve our vision.

To achieve such a vision, we need to think of the product, service, and its components to make it happen, considering factors as our customers, competitors, technology, and anything that affects the environment where a company develops.

In this article, we will see some product strategy examples to help you fill your product roadmap.

Product strategy is about how your product will win and position within a market.

Product Mix strategy

The Product Mix, also called Product Assortment, is known as the range of products a company offers, or its portfolio.

You can fundamentally manage your product portfolio in 4 dimensions: breadth, depth, length, and consistency.

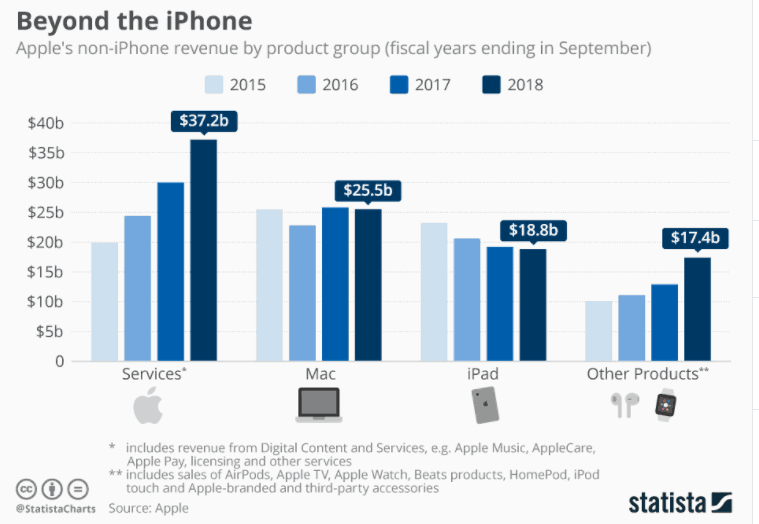

Breadth represents the number of product lines and categories a company offers. For example, Apple offers the iPhone, mac book, tablets. Each of these has complementary products; they’re all part of a broad of the personal electronics category.

While the personal electronics category is the most known one—and maybe the one that represents the most revenue for Apple—this Trillion-worth brand also offers its App Store, Itunes, and business applications.

Depth is about the set of offers each product line has.

Continuing with the iPhone example, you will find iPhone X, iPhone 8, iPhone 8 Plus, and more. They don’t variate only by yearly updates—which people mock of—but they’re addressing specific customer preferences they’ve identified into clusters.

These variations of products are marginal (i.e., augmenting, reducing or, changing modern features like screen size); more drastic changes would represent a different product line.

Lengths are the variations of each product within a product line. Apple, again, has different versions of iPhone 11: Pro, Max, Plus.

Consistency is not about more product lines or marginal variations, but an attribute of product portfolios: while the iPhone has many changes, they serve a whole general need and type of user. They’re all mobile devices; each variation addresses a specific use case and niche.

Product strategy based on life cycle

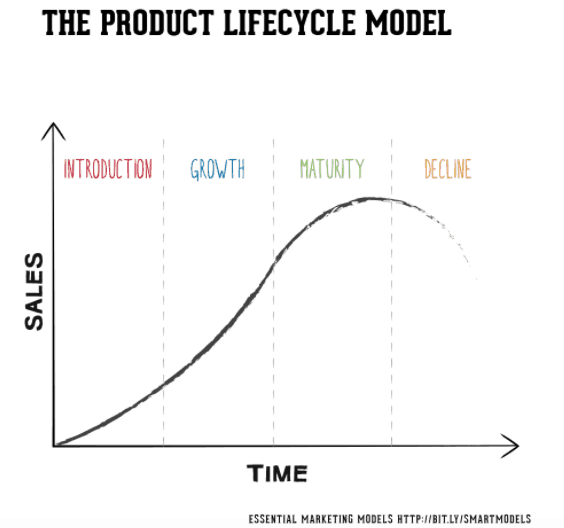

The Product Life-cycle (PLC) describes the stages of a product from launch to being discontinued. It is a strategy tool that helps companies plan for new product development and refine existing products.

In “International Growth is Product Management,” Vinay Ramani, Head of Global Growth at Uber, emphasized the importance of adapting your product to the unique needs of customers as you scale to new markets across the world.

Product introduction

These are some of the nuances when launching a new product (especially in technology space):

Your costs and expenses are at their lowest.

There is a misleading sense that you can keep your costs and prices low, and that will give you a competitive advantage. If your value proposition explicitly involves a feature, technology, niche, or distribution channels that fundamentally changes costs structure, then it can be part of your value proposition.

If that’s not the case, if you grow, you will eventually face the law of Diminishing Marginal Productivity and technical debt, even with the economies of scale law at your favor. In other words, your product will be more expensive to produce; your Cost per Acquisition (CAC) will rise, and keeping low prices will be hard.

Pursuing to position your product as the “best” or most complete solution is hard; market leaders dominate that space, they have more customers and reputation. Unless you’re introducing an actual disruptive technology, chances are you ought to go after niches: the first specific type of companies that would use your product.

Growth

Growth, generally, happens when your new product is solving a specific use case, it’s validated, and it’s ready to take on more customers (whatever the cost).

One of the debated tenants of growth is doing it at any cost: the objective is growing your customer base, even though that means increasing costs in hiring more people and increasing your marketing spend.

One of the prominent advocates of growth is Uber; Uber aggressively pulled free rides to get traction fast; they bet that their Customer Lifetime Value would be higher than their Customer Acquisition Cost.

In this article, Forbes even said that companies should choose between growth vs. profitability; for tech startups, the default answer was growth, but the latest SoftBank defeats like WeWork failing to launch an IPO, are re-defining priorities and discussions.

Also, these venture-backed startups and companies are the ones that resonate the most in media and case studies. Bootstrapping is an option, too.

Maturity

When a company reached Maturity, sales growth slows down, there’s a peak in sales, and your product is the default option for a use case or an industry. Product strategy should orient to retain customers and taking care of market share.

An excellent example of Maturity is Microsoft Excel, which has reigned as the leader for decades, even with alternatives of all types.

Decline

Product decline can happen due to a set of factors. In essence, you’re losing market share, competition is massive, and deprecating prices, other disruptive technologies are overcoming standard solutions, or overall demand for a product is contracting.

Canon is an excellent example of product decline; while in the past, it was the standard solution for digital photography, smartphones overtook them.

Canon still exists. Product decline doesn’t strictly mean product death, but market contraction. Product strategies during inevitable product decline include niche markets, understanding that the TAM (Total Addressable Market) will contract.

Product positioning strategies

Cost strategy: being the cheapest option

Your company wins by offering the lowest pricing. Typically, family basket goods fall within this category.

Low prices are commonly associated negatively as low quality.

However, there’s room for all kinds of companies to go after a cost strategy. Such an approach doesn’t only represent lower costs, but a different addressable market.

For instance, market democratization refers to the process where technology or a type of product becomes accessible for everyone (a.k.a it’s affordable by virtually anyone), and many companies and verticals fighting for such a goal.

Differentiation: being the best-in-class option

Differentiation is about standing out from the competition by having a unique value proposition or set of features that make you the best option available.

Differentiation doesn’t necessarily represent the highest sales volume or market share, but it generally serves the most top average ticket and A-class customers.

Pricing makes a fundamental part of differentiation as it generally involves the highest prices; even though you can tighten your margins, there’s a cognitive bias that dictates that pricing affects the perception of a consumer for a product.

In your product roadmap, thinking of features falls short; the additional price charged to your customers also means higher expectations and more likelihood of complaints.

This strategy pushes companies to go beyond delivering a functional product but delighting services and putting more effort into branding.

Focus strategy: being an authentically unique option

Focus strategy means looking after a niche and it’s the most common option as both cost and differentiation strategies require a kind of leadership in technology, processes or resources.

Building the best product for a niche is not about delivering the best features, but the best set of features according to the customers’ needs.

This is the case for project management software companies. Technically, a spreadsheet on Google Sheets on Excel + business emails can make most of the tasks and requirements to define projects, tasks, and deadlines. However, spreadsheets are generic and need a lot of customization.

While the project management landscape is pretty aggressive, leading companies have a set of features that make them better for specific use cases.

Asana, for instance, integrates with most web apps startups and digital businesses use, making it an integral part of team communication.

Microsoft Teams integrates with the Office 360 ecosystem, making it a good option for current Microsoft users.

Jira is the best option for software developers as its components, and features like code repositories, agile environment, and documentation make part of the daily functions a developer uses.

Technically speaking, they have the same core features; any database application has forms, a sort of automation, and user management (among others). But their incremental features and add-ons help them position their brands in a specific niche.

Counterintuitively, one way to lead in the focus strategy is being an all-in-one solution. These integrated solutions are made for large companies who want to have a set of features in one single place.

Product-Market growth matrix

We have featured the product-market growth matrix published by Igor Ansoff. It describes well the ways you can orient how your business will grow—including your product strategy.

The matrix overlaps products and markets according to their novelty; the newest represents the highest risk.

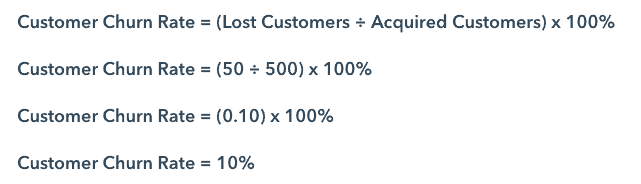

Market penetration is about offering your current products to a currently existing market. Your strategy should orient towards gaining and sustaining market share, which involves metrics like churn rate, which represents the percentage of your customer base that is leaving you on each payment cycle.

You can orient your product strategy towards retaining your current customers, gaining new ones through marketing campaigns, and stealing customers from your competitors.

Retention, generally, is a function of customer satisfaction; if your clients are happy with your product, they’re not likely to leave it. That’s why measuring satisfaction with tools like NPS (Net Promoter Score) becomes critical for some companies to identify why their customers might leave them.

Your product roadmap may orient towards identifying the friction points that may make your customers leave.

One of the best examples of market penetration is seen in the telecommunications space. It’s a broad market with nearly 100% of adoption where providers like Verizon and ATT&T in the US heavily fight through new campaigns, individual plans, and direct activities to make competitors’ customers make the switch.

Product development is about offering new products to a current, existing market.

A good example is the slow but consistent preferences of people to prefer healthy food options. The market is the same: restaurants, delivery, and mass consumption groceries satisfy the need for food with convenience. However, companies’ new normal is to offer fat-free, sugar-free, gluten-free, n-free versions of their products.

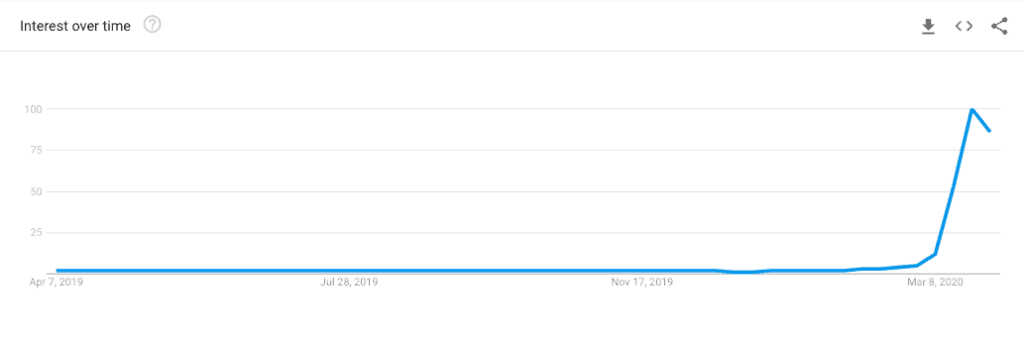

Market development is about offering the same product a company is offering but for new markets. One of the latest, more clear examples is the massive switch to remote work of traditional companies, driven by COVID-19.

Video conferencing tools like Zoom and async communications tools like Slack broadened their reach from digital businesses that can be run remotely to virtually any company that should operate.

Diversification is about developing a new product for a new market. Risk is at its highest as uncertainty for both products, and market factors are unknown for a company.

What could motivate a company to do such a change?

- Their current product portfolio is saturating or declining

- Technology and talent leadership lets companies switch where the next big things are

- Companies’ revenue is too reliant on a product category, and need to reduce the risk by diversifying their industry.

Blue Ocean Strategy

The Blue Ocean Strategy, widely known and used in the business community, describes how companies can eliminate competition by developing new markets. Blue and red oceans are metaphors for peaceful vs crowded and bloody markets—which companies should scape from.

Blue Oceans are markets that remain undiscovered, in which companies should create the demand.

In the book, Chan Kim & Renée Mauborgne, its authors share a set of tools to help you build your Blue Ocean Strategy. One of them is helpful to guide your product development: The Blue Ocean Matrix.

Product strategy examples

Media and entertainment companies switching to subscription-based streaming

Companies like Disney with Disney Plus are betting high on stealing market share for the streaming business model from a fairly new market developed by Netflix: Subscription-based streaming.

Business models enhanced by IoT

Through the Internet of Things, companies are bundling the sale of things with a subscription for apps to improve their services.

One successful case in the B2C space is Peloton, a company that sells exercise bikes along with an app that measures users’ performance that is shared with a cult-like community of riders.

For B2B, a case is General Electric in their industrial vertical not just selling manufacturing assets but preventive and predictive maintenance by placing sensors on their machines to gauge and monitor their conditions.